Credit to: theedgemalaysia.com

Real estate market to see steady growth ahead

This article first appeared in City & Country, The Edge Malaysia Weekly on March 3, 2025 - March 9, 2025

Malaysia’s property market, which experienced positive growth across all sectors in 2024, is expected to maintain steady growth in 2025, according to speakers at the Association of Valuers, Property Managers, Estate Agents and Property Consultants in the Private Sector Malaysia (PEPS) 17th Malaysian Property Summit (17MPS).

Held on Feb 20 at the Connexion Conference & Event Centre in Bangsar South, Kuala Lumpur, the summit was themed “Numbers Tell, Sentiment Sells: Decoding the Real Estate Market” and was attended by 296 participants. It was a full-day event with five discussion sessions on the overall property market outlook, a review of economic trends, commercial and retail market trends, prospects for the industrial property segment, and the residential segment’s performance and future.

The conference was organised by PEPS and supported by the Valuation and Property Services Department (JPPH), The Board of Valuers, Appraisers, Estate Agents and Property Managers (LPPEH), Royal Institution of Surveyors Malaysia, Malaysian Institute of Estate Agents, National House Buyers Association of Malaysia, Malaysian Institute of Property & Facility Managers, Malaysian Muslim Real Estate Consultant Association and Fiabci Malaysia. The Edge Malaysia was the media partner of the event.

Vibrant year ahead

In the first presentation, titled “Overview of the Malaysian Property Market: Gauging the Trajectory” and moderated by PPC International Sdn Bhd managing director Datuk Siders Sittampalam, Norhisham Shafie, director of the National Property Information Centre (Napic) in the Valuation and Property Services Department (JPPH), presented an overview of the latest trends and insights in the Malaysian property market across various sectors.

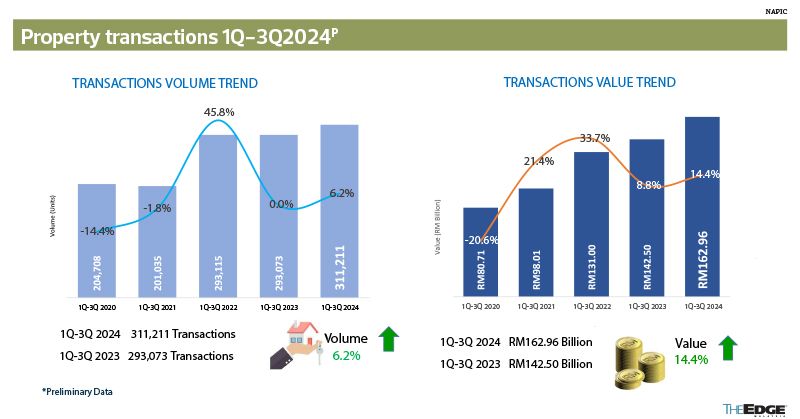

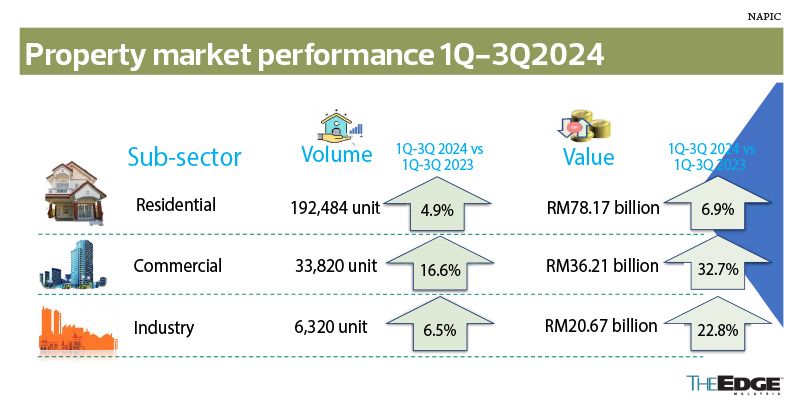

While the key property data of 4Q2024 were being finalised during the 17MPS, Norhisham highlighted some outstanding property market performance in the first nine months of 2024. This included a 6.2% year-on-year (y-o-y) increase in the total transaction volume to 311,211 transactions and a 14.4% y-o-y increase in the total transaction value to RM162.96 billion.

“The increase [in volume and value] was across the three main segments — namely residential, commercial and industry — with commercial leading. In 9M2024, the commercial segment saw a y-o-y increase in volume of 16.6% to 33,820 units and a 32.7% increase in value to RM36.21 billion,” he said.

Norhisham added that the growth was attributed to key infrastructure projects, such as MRT2 and MRT3, and transformative developments around Tun Razak Exchange (TRX) and Menara 118 that were rolled out last year, reinforcing Klang Valley’s position as a premier economic hub.

Outside the Klang Valley, projects such as the Johor-Singapore Special Economic Zone (JS-SEZ), Rapid Transit System (RTS) Link and Gemas-Johor Bahru double-tracking rail in Johor have reshaped Johor’s economy, drawing more foreign direct investment (FDI) and stimulating the commercial property market, he noted.

“In 2024, these efforts [infrastructure projects in Johor] drove outstanding growth in [Johor’s] commercial subsector with 7,563 transactions, up 33% y-o-y [as of 9M2024], and a transaction value of RM6.77 billion, a 54.9% rise. The industrial subsector also saw significant gains, with its transaction value climbing 46.3% to RM4.92 billion, solidifying Johor as a key economic hub,” he said.

For Sabah and Sarawak, Norhisham pointed out that the Pan Borneo Highway has significantly impacted local property transaction values, particularly in the industrial subsector. According to Napic’s data, Sabah recorded a transaction value of RM462 million in 9M2024, while Sarawak achieved RM419 million, up 8.6% and 16.7% y-o-y respectively. “This growth highlights the transformative influence of infrastructure development on the region’s economic landscape.”

Sharing his property outlook for 2025, Norhisham said he expects the property transactions in Malaysia to grow steadily this year, building on the positive momentum from 2024, with strong performance across the residential, commercial and industrial subsectors.

As for the overhang in the market, he noted a gradual decrease since 1Q2024 and said this signalled improved absorption rates, and supply and demand aligning. Coupled with increased construction activity, which enhances the supply pipeline for both residential and industrial properties, he said the overall property market this year would continue to be vibrant.

“Besides, infrastructure projects, such as the ECRL (East Coast Rail Link), RTS Link and Pan Borneo Highway, will continue to drive demand and boost development in key regions. The 2025 Budget initiatives, including affordable housing schemes and incentives for urban renewal, are set to strengthen market dynamics and support sustainable growth in the real estate sector,” he added.

Housing affordability still an issue

In the second session, titled “The Great Housing Debate” and moderated by Khong & Jaafar Sdn Bhd managing director Elvin Fernandez, speakers CBRE | WTW Malaysia group managing director Tan Ka Leong, Real Estate and Housing Developers’ Association (Rehda) Malaysia president Datuk Ho Hon Sang, and Khazanah Research Institute director of research Suraya Ismail discussed the current residential property market. The topics included market demand shifts, emerging residential housing trends, pricing trends and upcoming new developments. They also took a closer look at the impact of urban renewal policies and the lingering affordability challenges in the residential sector.

Discussing the housing affordability issue, Suraya said instead of making financing more accessible and “affordable”, industry stakeholders should focus on making house prices genuinely affordable.

“Cheap and easy access to financing induces artificial demand for housing. If the housing supply remains relatively inelastic, this increase in demand can push house prices even further, resulting in house buyers committing to more expensive housing in addition to directing future housing supply towards higher-priced houses,” she said.

Apart from the existing measures that have been implemented by the government, Suraya suggested refining some of the housing policies, such as reviewing the measurements of the three-time median multiple in cities and towns. “Currently, KPKT (Ministry of Housing and Local Government) has introduced guidelines in each state, but only at the urban and non-urban level. This is insufficient since housing markets are created at the levels of cities and towns.”

She also suggested discontinuing housing mortgages with periods of more than 35 years, as with a longer mortgage period, more house prices will increase due to financing. Meanwhile, she believed that implementing Khazanah’s down-market penetration ratio would help ensure that the incoming housing supply would not filter out the less affluent from its target buyer demographic, she added.

Taking a question from attendees on whether the bumiputera quota subsidy is still relevant in today’s market when the industry is trying to address the affordable housing and overhang issue, Suraya said a review of the policy is needed.

“We need to look back to history, where the policy was first introduced in the 1970s. The government wanted to ensure the inclusivity of all areas and prevent predominance by one race. Today, the discussion is no longer about that because we have achieved what we wanted to achieve and beyond. If we can socially coordinate ourselves and have the interest to stay together, I suppose this [the bumiputera quota] is no longer needed,” she said.

Commenting on the overhang, CBRE | WTW Malaysia’s Tan pointed out that while the overhang of residential properties has gradually fallen over the past four years, with a substantial reduction in properties priced above RM1 million, the data needs to be analysed more deeply in conjunction with small office/home office (SoHo) and serviced apartment segments.

“According to our own data analysis, serviced apartments and SoHos are likely to drive the overhang. They are the hidden overhang contributors. Hence, a breakdown of the price range for each type is required to have a clearer picture, so that we can avoid greater mismatch in supply and demand in addressing the overhang issue,” he noted.

According to Tan, Kuala Lumpur has the highest overhang properties, followed by Johor and Selangor, with a significant portion of overhang in the serviced apartment and SoHo property types.

The one-day 17MPS event attracted nearly 300 stakeholders from the property industry

Meanwhile, Malaysia has a strong domestic market, with a current housing stock of close to 6.8 million houses for a population of 34.1 million, indicating a shortage of 1.4 million houses, Tan said. “We can see the consumer preferences for housing shifted, with more priority given to convenience, accessibility, safety and affordability. And this pushed developers to focus on delivering high-quality products that emphasise green and integrated townships, with a commitment to continuously invest in infrastructure.”

However, a greater investment in building a sustainable and green development with innovative and creative features may further burden the developers, which are currently bearing higher construction costs, mainly driven by rising building material costs and minimum wages; higher land costs; environmental, social and governance (ESG) compliance costs; pre-grant assessment costs, especially for high-rise developments; and building compliance costs, according to Rehda Malaysia’s Ho.

“As a developer, we need to find a balance between providing quality products and our profit margin. We need to make sure what we launch is what the market needs and [will] be able to sell. Hence, data is very important for us to make decisions. A centralised database is a pivotal tool in decision-making. We also need it to understand the price range and shortfall in setting realistic targets for affordable housing development planning,” Ho said.

He also touched on the much-anticipated Urban Renewal Act, where Rehda has provided feedback and opinion to the government in setting the framework. “The perception that developers will be able to make high profits from redevelopment projects is not accurate, as such projects are financially risky and require strong financial capacity. However, we are in support of a facilitative urban renewal framework, which should include sustainable costs of redevelopment, transparent billing and inclusive engagement with stakeholders.”

Ho suggested providing incentives to developers that participate in the redevelopment projects. “Hopefully, we will be given incentives, both fiscal and non-fiscal, to ensure project visibility, realistic and practical expectations, like designs, resolution ... and a balanced output between safeguarding owners’ interests versus project visibility,” Ho explained.

Importance of FDIs for nation’s growth

In the third session, titled “Malaysia on the Global Investment Radar: A Review of Economic Trends and Our Competitive Advantage”, Malaysian Institute of Economic Research (MIER) executive director Anthony Dass discussed the Malaysian economy and its resilience in the face of global uncertainties. The session was moderated by Rahim & Co International Sdn Bhd director Choy Yue Kwong.

Anthony highlighted that Malaysia has emerged as a resilient and dynamic player in Southeast Asia, with FDI being crucial for the nation’s growth. “[FDI] contributes to increased economic activity, creation of jobs, improvement of infrastructure and exposure to cutting-edge technologies, which will benefit Malaysia.

“FDIs impact the Malaysian property market through several channels, industrial development, infrastructure projects, foreign buyer programmes and sustainability initiatives. This investment drives demand to build between industrial and residential properties, reduce overhang, stimulate economic activities and support the real estate sector,” he added.

Anthony forecast that the economy will remain resilient but cautious this year, with a projected 4.9% growth in gross domestic product (GDP). He attributed this growth to the investment cycle driven by FDIs, the 2025 Budget which will boost private consumption, and increased exports of semiconductors and natural resources.

“Interestingly, today with the current government, we are seen to be putting our presence more solidly on the international front where we’re looking at a lot of potential trade agreements, bilateral trade and so on. You must remember Malaysia is a small country, it’s a very open economy. So we need trade agreements and to diversify our exports, and that will potentially also help Malaysia going forward,” he added.

On that note, Anthony highlighted the need for targeted investment incentives to attract high-impact sectors, such as energy, technology and advanced manufacturing. He said Malaysia’s competitiveness is affected by its ability to offer attractive incentives, with countries such as Singapore and Thailand giving more competitive packages.

“These targeted incentives should be [on] a long-term basis and not just [for] the short term. So what are the high-impact sectors that should be eligible for the targeted incentives? It should be sectors like energy and natural resources; technology and digital economy; advanced manufacturing logistics; trade; defence and national security; and tourism,” he explained.

In terms of challenges, he said affordability is a major concern for the property market, with rising construction costs, interest rates, labour costs and material costs. “Even logistics and transportation expenses have gone up. The question is, how much of these costs can a company absorb? How much can they cut into their bottom line before having to pass some of the costs along? These are some aspects companies should look out for.”

Anthony said, in general, the property market has a moderate to positive outlook, driven by economic growth, sustainability policies and technological changes. He encouraged investors to focus on location-based developments and to be prepared for the challenges and opportunities presented by the Madani Economy framework.

Office and retail markets see recovery

The fourth session, titled “Commercial & Retail Markets: Reviving Interest and Moving Forward”, featured speakers PHB Property Ventures Bhd head Fauziah Mohd Azali and Knight Frank Malaysia Sdn Bhd executive director Amy Wong as well as moderator MacReal International Sdn Bhd co-founder Michael Kong.

As a representative from PHB, which is a real estate investment holding company and a wholly owned subsidiary of Yayasan Pelaburan Bumiputra, Fauziah started by providing an overview of how the company’s properties performed last year. “Last year, our portfolio’s offices recorded stable rental rates, which is a rebound from their slight drop during the pandemic. We also saw competitive leasing strategies where flexible terms, enhanced amenities and tailored workspaces are provided. There were many offices incorporating ESG and wellness features to drive occupancy.”

She noted that the office market is evolving and companies are no longer seeking large, traditional office layouts. “As landlords, we must stay ahead and adapt to challenges such as oversupply, remote work and shifting tenant needs.”

On how PHB mitigates the impact of office oversupply, Fauziah explained that the company practises two key strategies. This includes tenant retention by making rent adjustments to match market conditions, creating a tenant-centric ecosystem and increasing tenant engagement; and repositioning underperforming assets through asset enhancement strategies and repurposing buildings.

“Not all of our buildings are performing well or highly sought after. For underperforming properties, we have taken steps to convert some office spaces into co-working spaces. We’ve introduced flexible layouts and shared spaces to make these properties more functional and attractive to the market.

“Since asset performance evaluation is crucial, we prioritise and capitalise on our best-performing buildings, particularly those near public transportation. [Co-working spaces as well as universities and similar institutions often prefer buildings like these].

“Additionally, branding and SME (small and medium enterprises) support play a key role. Offering tenants perks like signage and naming rights can enhance visibility, while curating and customising spaces to suit their needs adds to the overall appeal, ultimately helping to drive occupancy,” she added.

In terms of retail assets, Fauziah observed that over 50% of retailers in PHB’s portfolio adopted multi- or omni-channel strategies in 2024, integrating physical stores with online platforms to meet evolving consumer expectations. She added that as a landlord, PHB provides the necessary infrastructure, such as high-speed internet, to support these transitions.

Despite e-commerce growth, she said physical stores remain relevant, including short-term pop-ups that allow start-ups to test the market before committing to permanent leases.

“Retail spaces are also evolving into family-friendly hubs, hosting community engagement events. Additionally, tourism recovery, now at 91% of pre-pandemic levels, is driving experiential shopping trends.

“Sustainability is another key focus, with malls implementing eco-friendly upgrades like EV (electric vehicle) charging stations, LED lighting, recycling programmes and initiatives such as food composting. Green retail spaces featuring sustainable designs and zero-waste concepts are becoming the norm,” Fauziah added.

Knight Frank’s Wong gave an overview of the office and retail sectors, and highlighted market sentiments and current trends based on the Knight Frank Global Corporate Real Estate Sentiment Index 3Q2024.

“The global sentiment remains challenging overall. [Firstly,] at a global level, there are minimal expectations for headcount growth, meaning we’re not seeing significant office expansions. Secondly, offshoring continues as a key strategy for capital expenditure rationalisation, which is actually beneficial for Malaysia, as we are one of the leading offshoring destinations.

“Thirdly, hybrid and flexible working arrangements are here to stay. While many have been called back to the office, flexible work remains essential, especially as Gen Z and Gen Alpha enter the workforce. Fourthly, sustainable buildings will continue to have a competitive edge over non-green buildings. Even if the US exits the Paris Agreement, such policies tend to change over time, and green buildings will remain a priority in the long run.”

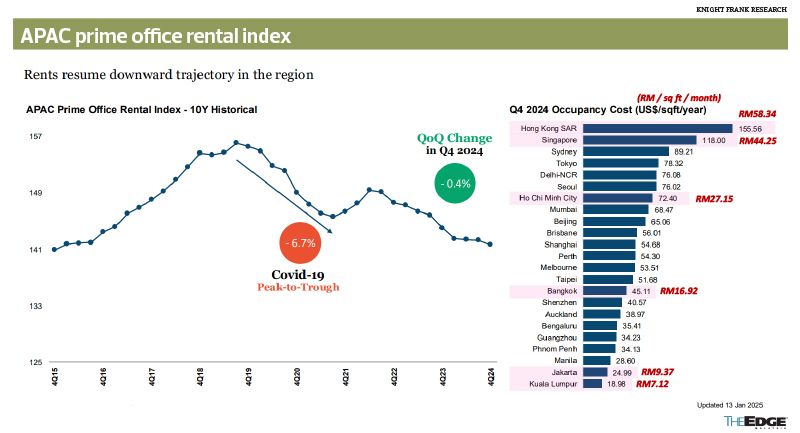

Wong went on to examine key performance indicators such as rental rates, occupancy and supply in the Asia-Pacific (APAC) region and said the APAC office market appears well-positioned to navigate short-term volatility despite economic headwinds. She added that the market is still recovering from the pandemic, causing prime office rents to decline by 7% across the region.

“Interestingly, Kuala Lumpur’s prime office rents remain the most attractive in the Asia-Pacific region at RM7 psf per month, compared with RM58 psf in Hong Kong and RM44 psf in Singapore. This affordability makes KL highly competitive for MNCs.

“In terms of rental growth, KL recorded a 2.1% y-o-y increase, driven by demand for newly completed premium office spaces, which have helped raise rental benchmarks. Across the region, the widely discussed ‘flight to quality’ trend is fuelling demand for well-located, high-quality office spaces with strong sustainability credentials. While rental rates have risen due to demand for better-quality spaces, we do not anticipate a dramatic spike in rents,” she said.

Wong said the office market will see steady recovery this year, driven by resilient demand. She noted that the Klang Valley office market is experiencing gradual improvements in rental and occupancy rates. This growth is supported by strong demand from both local and international occupiers, attracted by cost-effectiveness, high-quality spaces and a skilled workforce.

She also pointed out that despite the current cautious investment climate, the Klang Valley office market appears to have long-term potential. “While economic uncertainties have led to a cautious investment approach, prime office assets with strong tenancy profiles and strategic locations remain attractive to long-term investors seeking stability and growth opportunities in the Klang Valley market.”

With sustainability becoming a key factor in occupier decisions, Wong said more businesses are prioritising office spaces that align with ESG benchmarks and green building certifications. “This shift reflects a broader commitment to corporate sustainability and long-term operational efficiency.”

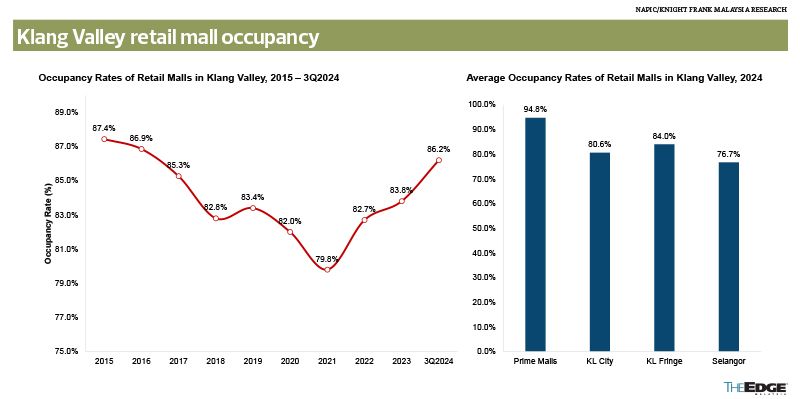

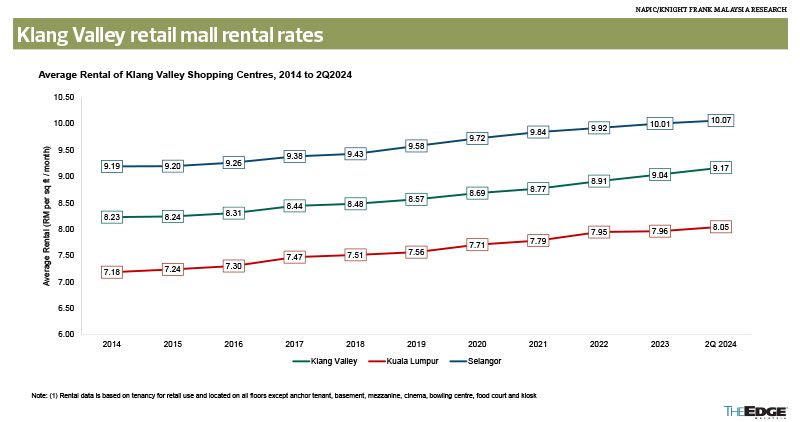

For the retail sector, she said retail sales increased by 3.8% in 3Q2024, driven by strong domestic demand and rising tourist spending. Growth is projected to accelerate to 4.4% in 4Q2024, with an annual increase of 3.9% for the year.

Wong said she foresees that government policies will drive spending. “Cash handouts and wage adjustments are expected to support private consumption. However, the expansion of the sales and service tax and fuel subsidy cuts may influence spending patterns, shifting demand toward essential goods and value-driven purchases.”

Another issue she highlighted was how inflation is pressuring retailers to rethink pricing and operations. Wong said rising costs are prompting retailers to optimise supply chains and adjust pricing strategies. “Businesses focused on essential goods and cost-efficient operations are best positioned to navigate these inflationary challenges.”

Demand for industrial spaces still prevalent

The final session titled, “The Industrial Market: Growth Trends and Long-term Sustainability”, was led by speaker Rahim & Co International Sdn Bhd real estate agency CEO Siva Shanker and moderated by CBRE | WTW Malaysia adviser Foo Gee Jen.

Siva discussed the current state of the industrial market in Malaysia and highlighted its growth and potential. “The industrial market has improved by 6% to 8% overall, with some states performing better than others. Penang is a bit of an anomaly [with a 16.6% drop in transactional volume] because in the year before, there were a lot of transactions.

“Currently, overhang units are minimal and not a significant issue, although this may change in the future. Most of the oversupply is concentrated in cookie-cutter units, single-storey terraced factories and semi-detached factories.

“These are often developed for quick gains, with developers building, selling to speculators, and hoping to find tenants or buyers upon completion. As a result, many of these units remain vacant, contributing to a small but notable overhang in the industrial sector,” he added.

Siva went on to say the industrial sector had attracted significant attention over the past few years, with many funds actively pursuing industrial properties. However, industrial rents remain highly inelastic.

“Manufacturers may be able to absorb slightly higher rents, but logistics operators, who operate on razor-thin margins, cannot afford even the slightest increase without serious financial strain. This inelasticity has led to sustained rent stability, but property prices have continued to rise due to intense competition among investors.

“As a result, yields have declined, now ranging between 5.75% and 6.2%, a notable drop from the over 7% returns achievable just five years ago. This shift raises concerns about the long-term sustainability of the market,” he said.

Similarly, the surge in data centres setting up in Malaysia also has its downside, Siva cautioned. “We have Google, Nvidia, Microsoft and Amazon, all the big names coming in. And honestly, it’s mostly because Singapore put a pause on data centres for a while. When Singapore said no, these companies had to go somewhere, and the obvious choice was just across the causeway — Johor.

“What happens when all these massive data centres start eating up our electricity and water? Honestly, we’ll be the ones struggling while these centres keep running non-stop because we’ve promised these companies that their servers will stay cool. My concern is, we’re jumping onto this trend the same way we did with serviced apartments. If we’re not careful, we’re going to end up with an oversupply of data centres too.”

Siva also discussed the changing landscape of logistics and warehousing in Malaysia, highlighting a shift towards larger, more sophisticated facilities. The growth of e-commerce has driven demand for warehousing space, and he expects this trend to continue.

With the ECRL set to be completed in end-2026, Siva highlighted that this key infrastructure project will be a game changer by further enhancing the country’s connectivity and trade.

“With that in place, travel time between key locations will be cut down to just a few hours. For those in the shipping business, this is huge. Rather than going the long way around, you’ll be saving at least a day, maybe even two, by cutting straight across the peninsula. With this new efficiency, I believe Kuantan is set for an upswing.”

With regard to the industrial property market outlook, Siva said the supply of logistics warehouses is growing and the average rental rates will most likely remain the same this year. He foresees major growth in industries such as aerospace, batteries, microchip and medical devices, as well as demand for more logistics space in the coming years, with online marketing businesses continuing to expand.

We use cookies to improve your experience and to help us understand how you use our site. Please refer to our cookie notice and privacy policy for more information regarding cookies and other third-party tracking that may be enabled.